Why have markets grown more captivated by data releases?

Especially when the quality of statistics is deteriorating

EIGHT-THIRTY in the morning on the first Friday of every month is a special time for bond traders: it’s when America’s Bureau of Labour Statistics usually releases its monthly jobs data. Despite the vast sums that some hedge funds spend on alternative data, landmark releases like the employment report or the consumer-price index (CPI) can still convulse markets. When the September payrolls numbers, released on October 4th, blew past expectations, bond yields jumped by eight basis points (0.08 percentage points). Stocks spiked, too, though the move was short-lived.

Explore more

This article appeared in the Finance & economics section of the print edition under the headline “Arithmomania”

Finance & economics October 12th 2024

- How America learned to love tariffs

- Could war in the Gulf push oil to $100 a barrel?

- Europe’s green trade restrictions are infuriating poor countries

- Can markets reduce pollution in India?

- Why have markets grown more captivated by data releases?

- China’s property crisis claims more victims: companies

- How bond investors soured on France

- Can the world’s most influential business index be fixed?

Discover more

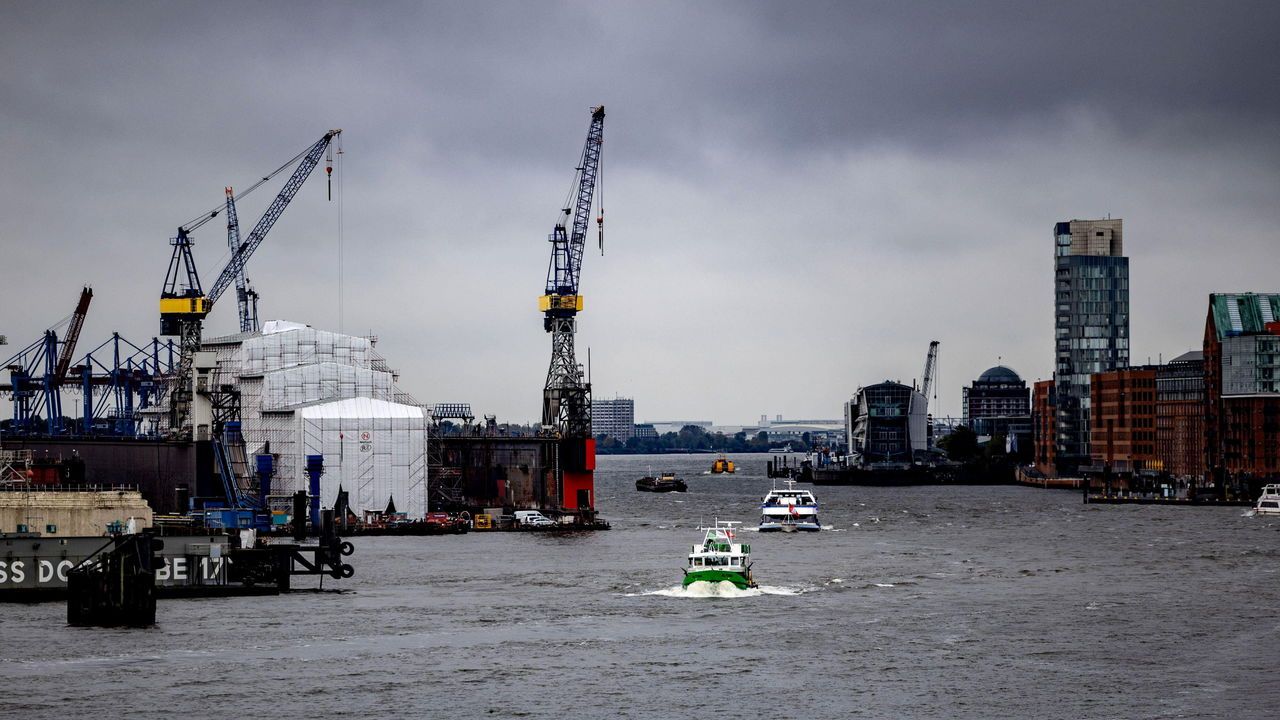

Germany’s economy goes from bad to worse

Things may look brighter next year, but the relief will be short-lived

An economics Nobel for work on why nations succeed and fail

Daron Acemoglu, Simon Johnson and James Robinson tackled the most important question of all

Why investors should still avoid Chinese stocks

The debate about “uninvestibility” obscures something important

China’s property crisis claims more victims: companies

Unsold homes are contributing to a balance-sheet recession

Europe’s green trade restrictions are infuriating poor countries

Only the poorest can expect help to cushion the blow

How America learned to love tariffs

Protectionism hasn’t been this respectable for decades