Masayoshi Son is back in Silicon Valley—and late to the AI race

This isn’t the first time the Japanese tech investor has missed the hot new thing

MASAYOSHI SON is a man of contrasting superlatives. At the height of the dotcom bubble in early 2000 the Japanese technology mogul was briefly the world’s richest person, before losing $77bn in paper wealth, more than anyone before. In 2021 SoftBank Group, his telecoms-and-software conglomerate turned investment powerhouse, reported the biggest annual net profit in the history of Japan Inc, followed a year later by the second-biggest loss. His $20m wager in 2000 on Alibaba, a tatty online marketplace that grew into China’s mightiest e-emporium, counts as one of the best in the annals of venture capital (VC); his later $16bn punt on WeWork, an office-rental startup with tech pretensions, is an all-time dud. He has been called a “genius” and “dumb money”.

Explore more

This article appeared in the Business section of the print edition under the headline “Stuck in the future”

Business October 12th 2024

- Big tech is bringing nuclear power back to life

- Can Mytheresa make luxury e-commerce a success?

- Can Israel’s mighty tech industry withstand a wider war?

- Ratan Tata, a consequential and beloved figure in Indian business

- China is writing the world’s technology rules

- When workplace bonuses backfire

- Masayoshi Son is back in Silicon Valley—and late to the AI race

Discover more

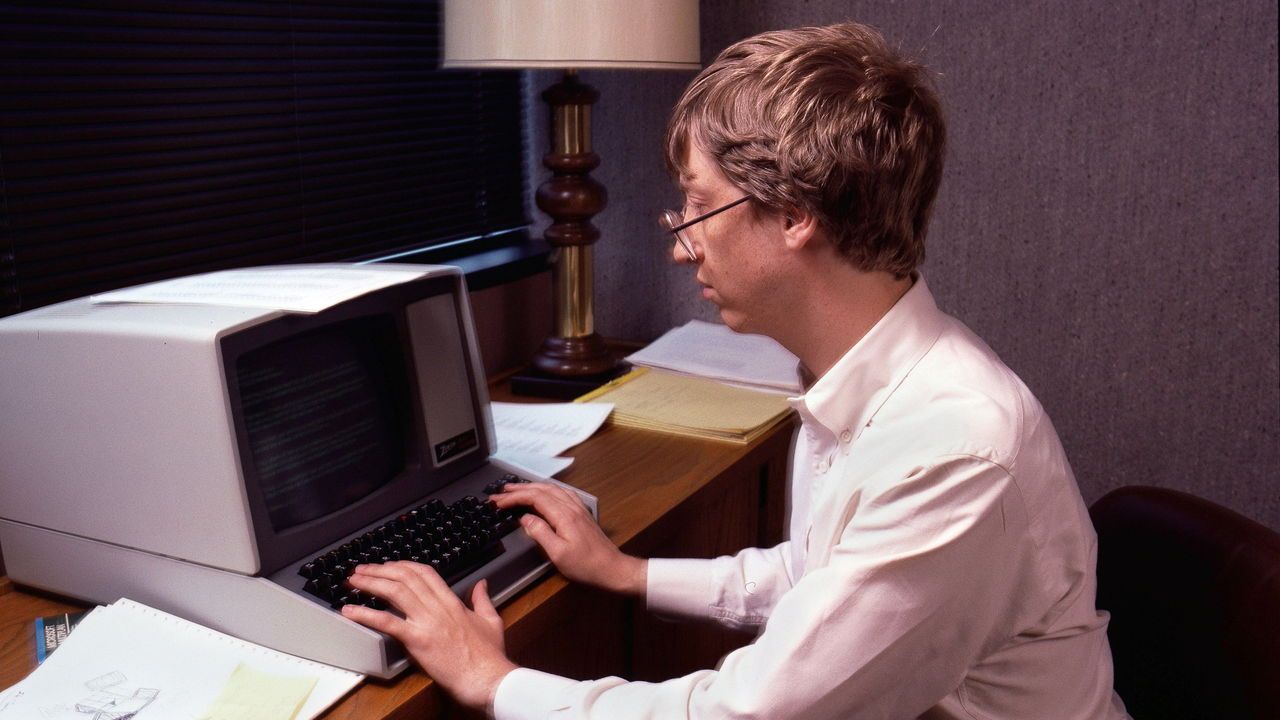

Why Microsoft Excel won’t die

The business world’s favourite software program enters its 40th year

The trouble with Elon Musk’s robotaxi dream

Scaling up self-driving taxis will be hard, and competition will be fierce

Sir Jim Ratcliffe, chemicals magnate turned sports mogul

The British billionaire is buying up teams from sailing to football to cycling

When workplace bonuses backfire

The gelignite of incentives

China is writing the world’s technology rules

It is setting standards for everything from 6G to quantum computing

Can Mytheresa make luxury e-commerce a success?

It reckons it can succeed where Richemont has failed